DST GROWTH OFFERING

ALL EQUITY DSTs TARGETING LAND

Walton’s Delaware Statutory Trust (DST) Growth offering is a 1031 exchange strategy designed for United States residents, who are accredited investors, searching for a capital gains deferment solution and potential preservation of capital through a hard asset. Our DST land offering is focused on growth with an estimated target hold period of 3-5 years.

TARGETING GROWTH FOR DST INVESTORS

Overall returns from DST structures involving land have the potential to be higher than traditional DSTs that primarily focus on income producing properties, such as tenant occupied developments that generate monthly or quarterly income of 3%-5%. While both strategies have their own merits and risks, the return potential of a land-based DST can help investors diversify their DST portfolio with a focus on total returns.

INVESTMENT STRATEGY

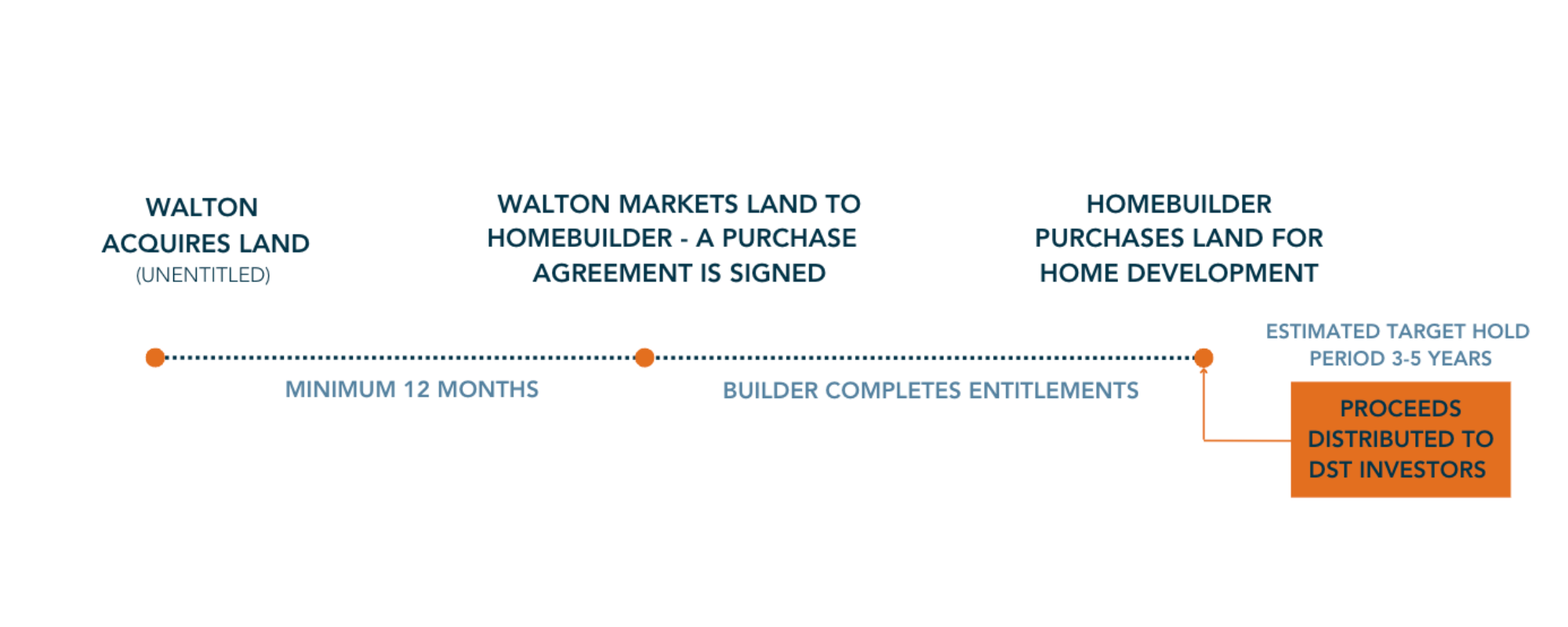

Our land acqusition team is constantly filling our DST pipeline with land that meets our DST criteria including size and near-term development. Once Walton acquires the land, it is held for a period of time before a home builder prepares the land for home development.

What is a 1031 Exchange?

A 1031 Exchange, named for Section 1031 of the U.S Internal Revenue Code, is a transaction approved by the IRS that allows real estate investors to defer the tax liability or capital gains taxes on the sale of an investment property. DSTs are considered direct property ownership for tax purposes which makes them eligible for tax-deferred 1031 Exchanges, recognized by the IRS as qualified replacement property for the transaction.

What is a DST?

A DST, or Delaware Statutory Trust, is a legal entity that, if structured properly, allows investors to own undivided fractional ownership interests, treated as direct ownership, in professionally managed institutional grade real estate offerings around the U.S.

Who can invest in a DST?

An accredited investor who resides in the United States can invest in our DST offering. Investors who are looking for a replacement property to defer their tax liability are typical candidates for a DST investment, but our offering is open to all accredited investors who would like to defer their tax liabilities. DST interests are sold as securities, so investors must work with a registered broker-dealer or registered investment adviser.

How does the Walton DST investment work?

Walton’s DST offering is a private placement structure that includes a debt free, 100% equity investment opportunity that uses land needed by national home builders for new home development with an estimated target hold period of 3-5 years.

- Walton acquires land using an “all cash” transaction in high growth areas in the U.S.

- A national homebuilder agrees to buy the land for future home development through an option agreement

- Distributions are made to DST investors as land is sold to homebuilders

Does the Walton DST investment appreciate in value?

Investors can expect traditional appreciation based on market conditions, and the potential increase in value to the land upon entitlement completion by the builder. Once a builder signs a purchase agreement for a land parcel they expect to buy, they begin the entitlement process and eventually purchase the land from the DST to build homes.

The investment in the land made by the home builder during the purchase agreement process is passed on to DST investors at the time of the land sale. For the DST investor, they have invested in a DST that owns property in the path of future development. The DST does not modify, either legally or physically, the property it owns. Instead, the DST’s investors have acquired an interest in real estate for the purpose of realizing on its future value.