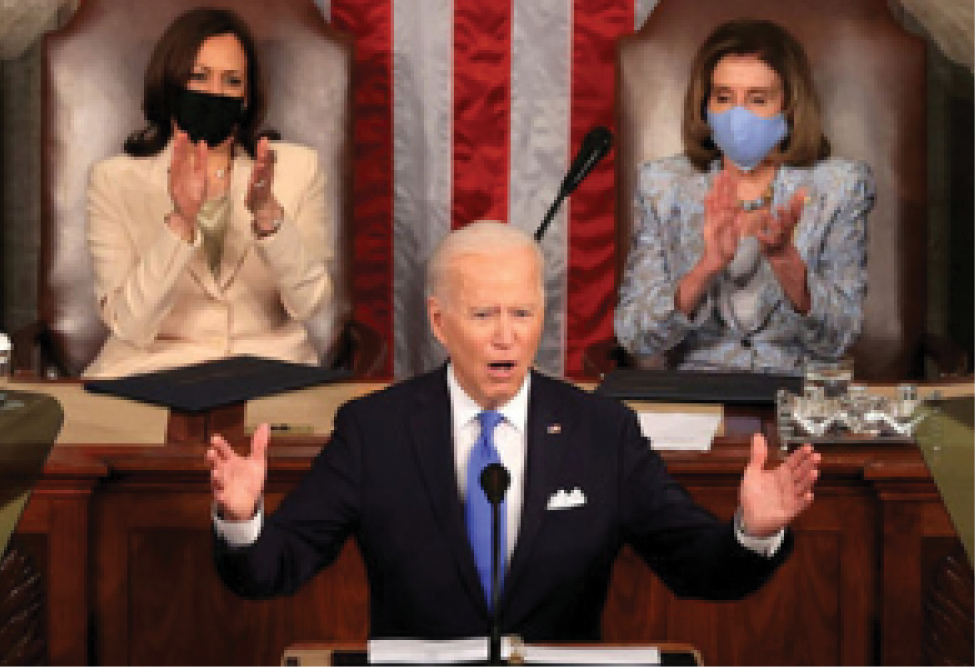

US President Joe Biden’s “soak the rich” tax increases are expected to offer an incentive for United States expats to give up their citizenship, a tax adviser says.

Increasing taxes and citizens-based taxation are strong motivations to renounce, says Daan Durlacher, founder at Americans Overseas, a Netherlands-based company specializing in US tax preparation for US citizens abroad.

“As most of our clients are Americans living and working and therefore paying tax overseas, and in a lot of cases pay double tax – resident taxation and the US citizens taxation – more and more dual nationals are renouncing,” Durlacher says.

The higher the tax rate, the more the benefit of expatriating, says Robert Keys, a partner of PricewaterhouseCoopers.

“If you’re in a place like Hong Kong or Singapore, where the rates are under 20 percent, the benefit of giving up your citizenship is the delta between the US tax rate and that country’s tax rate. Plus, a place like Hong Kong doesn’t tax capital gains,” Keys says.

But the US imposes an “exit tax” on a US expatriate who has a net worth of more than US$2 million (HK$15.6 million), or an average annual net income tax of more than US$172,000 over the past five years, or fails to comply with federal tax obligations over the past five years.

Meanwhile, a US recipient of gifts or bequests from expatriates who were subject to the exit tax is required to pay a tax on those assets at a 40 percent rate.

The number of Americans who gave up their citizenship more than tripled to about 6,700 in 2020 from a year before, according to tax adviser Bambridge Accountants New York.

The US taxes its citizens on their worldwide income no matter where they reside, including capital gains on foreign investment properties.

Biden is reportedly seeking to nearly double the tax rate on capital gains to 39.6 percent for people earning more than US$1 million.

That rate would be added to the 3.8 percent net investment tax which helps fund the Affordable Care Act, known as Obamacare, bringing the top capital gains rate to 43.4 percent.

“Almost everything you own and use for personal or investment purposes is a capital asset. Examples include a home, personal-use items like household furnishings, and stocks or bonds held as investments. When you sell a capital asset, the difference between the adjusted basis in the asset and the amount you realized from the sale is a capital gain or a capital loss,” according to the website of the IRS.

The capital gains tax increase would only hit 0.3 percent of households, White House economic adviser Brian Deese has said.

“Congress is likely to opt for a more modest tax increase than [what] the President is suggesting. Our base case is for the top rate to increase to 28 percent, with lawmakers pushing back at the near doubling suggested by the administration,” strategists led by Mark Haefele, chief investment officer at UBS Global Wealth Management, write in a note.

The White House has also called for raising the corporate tax rate to 28 percent from 21 percent to fund infrastructure spending.

The increase in capital gains tax is also unnerving investors in Asia who have invested in US property.

Walton International, a US-headquartered real estate investment firm that offers investors exposure to North American real estate through purchasing pre-development land, has received inquiries from clients in Asia on Biden’s capital gains tax plan.

“Their main concern is that the capital gain profits made on their real estate investments will be taxed at a higher rate because of the proposed increase in the capital gains tax rate,” says Gary Tom, president of Walton International in Asia.

But Tom adds that Walton does not see any concerns for the majority as the tax increase is on the top-tier. “In most cases, our investors are at the 0 percent and 15 percent on the tax level, and there are different ways to structure and plan to minimize through professional advice.”

The tax rate on long-term capital gains, applied to assets held for more than a year, is either 0 percent, 15 percent, or 20 percent, depending on one’s income.

Luxury properties and coastal cities with higher state tax may feel a bigger impact, such as California and New York, where the combined state and federal capital gains rate could be above 50 percent, Tom says.

Suppose a Hongkonger sells an apartment in the US for US$1.2 million and earns a capital gain of US$200,000. The capital gains tax will be around US$24,000 at the federal level, according to Walton International.

However, at the time of sale, the seller needs to pay more than the actual captial gains tax amount to the IRS as withholding tax, which is equivalent to up to 15 percent of the selling price. In this case, it will be US$180,000. He can file a tax return to the IRS for a refund of the excess amount paid.

“While we do not think that governments will want to risk suppressing the business cycle in its early stages, in the medium term the probability of increased taxes is high – and is already being discussed in many countries,” strategists led by Christian Nolting, global chief investment officer at Deutsche Bank Wealth Management, say in a report.

The US is also advocating a global minimum corporate tax rate of 21 percent, which has got backing from France and Germany.

European Union countries are obliged by EU agreements to have a strategy to reduce their debt to sustainable levels, and higher taxes are a means to increase government revenues and thus ultimately reduce debt and debt payments, Deutsche Bank analysts say.

On the currency side, a US tax rate increase will limit Treasury yields, because higher taxes are considered a negative factor to the US economic recovery, and as a result, the rebound of the greenback will continue but to a lesser extent, says Bruce Yam Hiu-ping, forex strategist at Everbright Sun Hung Kai.