INSIGHTS

MARKET OUTLOOK

AUGUST 2025

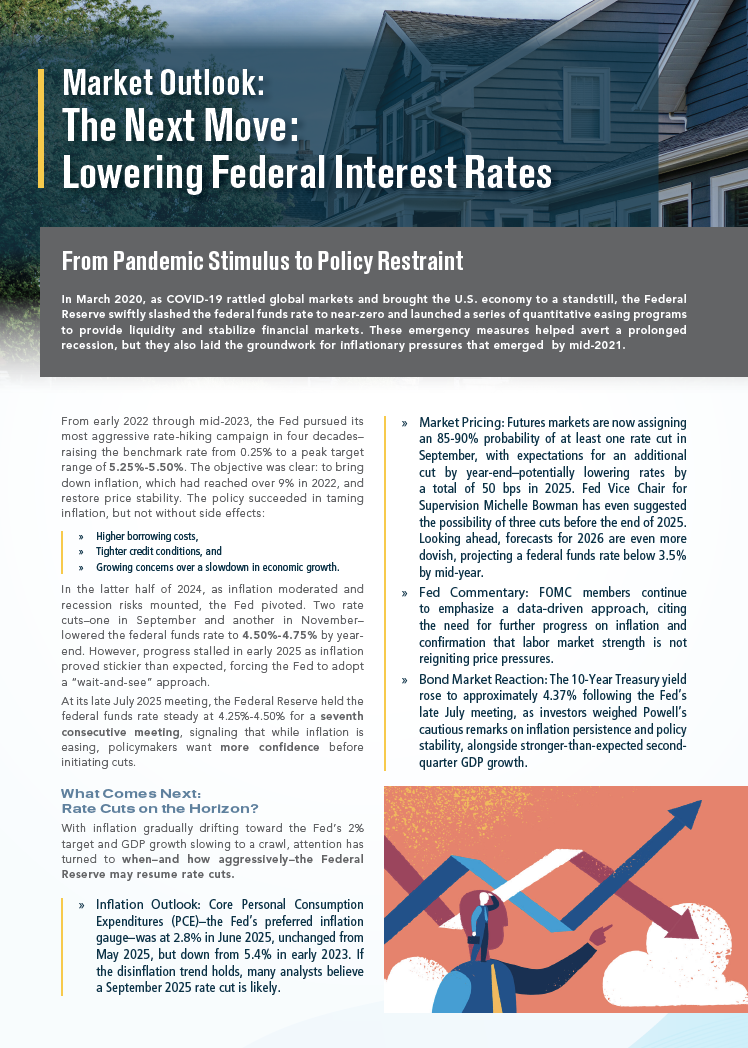

The Next Move: Lowering Federal Interest Rates

Our latest Market Outlook explores the implications of the Federal Reserve’s next potential move: lowering interest rates–and how this shift could reshape the U.S. economy, housing, and land investment.

Highlights:

-

Fed Policy & Inflation: After two cuts in late 2024, the Fed has held rates steady at 4.25%-4.50% through mid-2025. Inflation is easing, and futures markets price in a high likelihood of cuts starting in September 2025 .

-

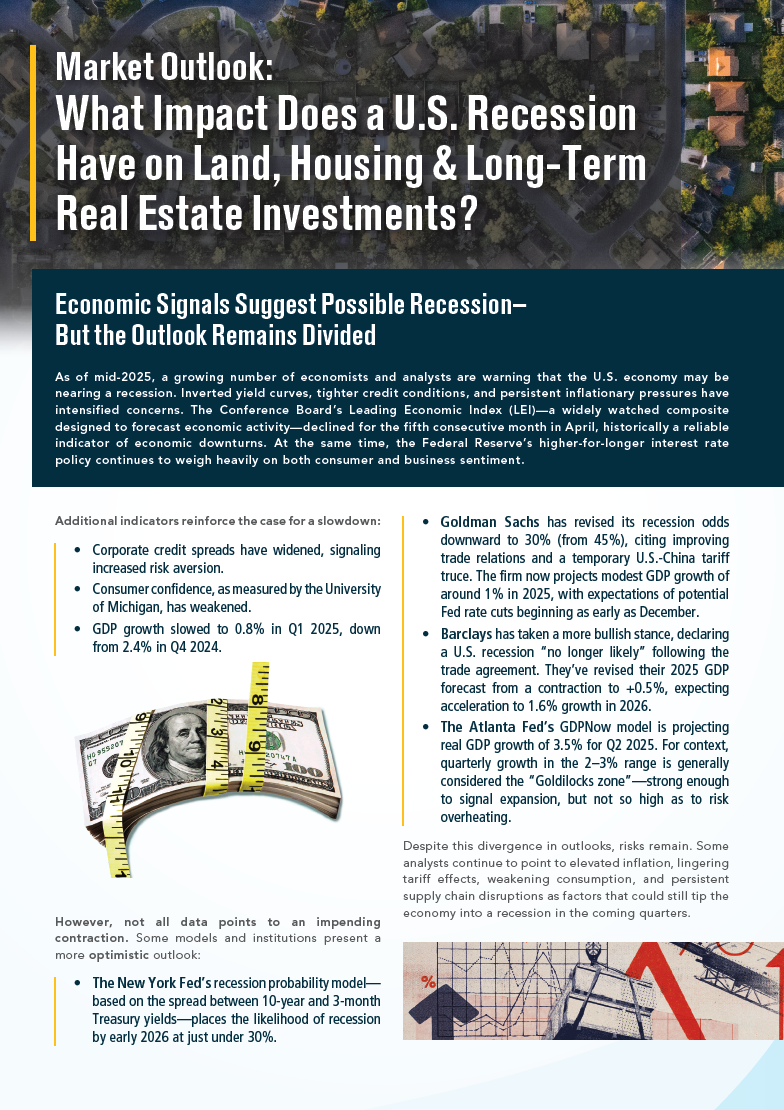

Economic Outlook: GDP growth is slowing, consumer spending is rebounding, unemployment is steady near 4.2%, and recession risk has fallen to 28% from 50% last year .

-

Housing Market: Lower mortgage rates (potentially falling to 5.75%-6.25% by mid-2026) could unlock affordability for millions of households and stimulate new construction .

-

Builder Strategies: Homebuilders are cautiously optimistic, using “land-light” models while inventory remains undersupplied by 2-6 million units .

-

Investor Sentiment: First-time buyers and institutional capital are expected to re-enter markets as affordability improves. Land values, historically resilient, may see strong appreciation in the next cycle .

-

Walton Global’s Position: Our entitlement expertise, builder partnerships, and asset-light approach position us to capitalize on housing’s next expansion phase.

CLICK THE REPORT IMAGE TO VIEW OR DOWNLOAD HERE

MARKET SNAPSHOT

MAY 2025

Trump’s Middle East Visit Sparks Trillions in Trade and Investment Deals

President Trump’s visit to Saudi Arabia, Qatar, and the UAE resulted in over $2 trillion in trade and investment agreements, signaling a strategic pivot to economic diplomacy in the region.

Key highlights include:

-

Saudi Arabia: $600B U.S. investment pledge, major AI chip deals with Nvidia and AMD, and expanded bilateral industrial ties.

-

Qatar: $1.2T in economic exchanges, including a record $96B Boeing aircraft order and defense contracts with Raytheon and General Atomics.

-

UAE: A 10-year, $1.4T investment framework spanning AI, renewables, and logistics, with $25B earmarked for U.S. energy and data infrastructure.

Market Implications:

-

Short-term: Boosts for U.S. firms like Boeing, Nvidia, and Raytheon.

-

Long-term: Deeper Gulf participation in U.S. capital markets and technology co-development.

-

Reflects a realignment of global capital flows from oil to high-tech, energy, and defense, benefiting U.S. economic resilience and industrial growth