US $20M EXIT OFFER FROM LEADING U.S. REAL ESTATE DEVELOPER

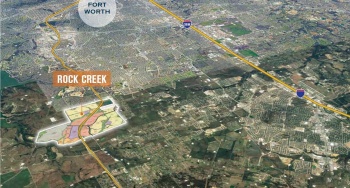

In July 2019, Rock Creek West landowners voted to accept a US$20M exit offer from a leading U.S. real estate developer headquartered in Dallas, Texas. According to the terms of the option agreement, the purchaser is responsible for securing final approvals before undertaking construction of onsite & offsite services necessary for a large master planned residential development. The property will be acquired by the developer in a series of phased takedowns, delivering a projected US$20 million in cash flow to be distributed to landowners over the course of ten years. The first closing is expected in 2021.

Landowners will continue to own approximately 217 acres of commercial land within the Rock Creek West property, which will benefit from the progress of the adjacent residential development.

TAILORING INNOVATIVE EXIT STRATEGIES TO MEET MARKET TRENDS

The Rock Creek West exit represents a further step in Walton’s ongoing efforts to collaborate with leading real estate developers across the U.S. on exit structures that generate mid to long term cash flow for our investors.

We believe this option-to-purchase exit structure benefits our investors by delivering the clarity of a defined timeline and revenue stream. In return, the purchaser benefits from securing a stable supply of land in a large master planned community. Landowner and purchaser interests are aligned through the terms of the option agreement which require that the purchaser funds significant infrastructure costs up front, thereby ensuring that they continue the development to completion in order to recoup their investment.

This exit strategy reflects a broader shift in the homebuilding industry towards just-in-time inventory, with homebuilders and developers of all sizes increasingly seeking to reduce the pressure of land inventory on their balance sheets. By securing land inventory through option agreements, developers can better align liabilities with revenues, thereby enhancing operational efficiency. It also frees up capital to invest in the costly up-front infrastructure required to kick off the early phases of development in a large master planned community.

At present, the U.S. housing market enjoys solid fundamentals with healthy population growth, employment growth, steady building permit issuance and strong builder confidence. Nationwide, millennials are driving housing demand as more first-time buyers enter the market. With demand for development-ready land forecast to grow rapidly over the coming years, Walton expects to play an increasingly important role in the U.S. homebuilding industry.

The Walton Group of Companies is one of North America’s leading real estate investment and asset management groups, focusing on the research, acquisition, planning, management and administration of raw land strategically located in growth corridors across the United States and Canada. Assets under management or administration exceed USD 3.8 Billion and comprise over 106,000 acres of land in 22 markets in North America.